New York City to Become Largest City in America

to Recognize LGBT-Owned Businesses

Historic agreement between NYC Dept. of Small Business Services

and National LGBT Chamber of Commerce, five years in the making

January 19, 2021

Washington, D.C. – The National LGBT Chamber of Commerce (NGLCC), the business voice of the LGBT community, is proud to announce that New York City Small Business Services (SBS) has approved a measure to include NGLCC Certified LGBT Business Enterprise® (Certified LGBTBE®) suppliers in contracting and procurement opportunities, as well as capacity building and educational programs from small businesses, throughout the city. For LGBT citizens of New York City, this inclusive policy provides fair and equal access to economic development programs that drive innovation, create jobs, and promote economic growth throughout the city.

“Thanks to the leadership of NGLCC, Mayor Bill de Blasio and the NYC Department of Small Business Services– especially Commissioner Jonnel Doris and Deputy Commissioner Dynishal Gross– LGBT entrepreneurs in New York City will now have the opportunity to create jobs and develop innovations that benefit all who live there. New York City has a legacy of leadership in promoting inclusivity at every level of public life. Now, history has been made here in New York City, and this victory for inclusivity has once again proved our core values that ‘diversity is good for business’ and that ‘if you can buy it, a certified LGBT-owned business can supply it.’ We are excited to see LGBTBEs in every field, from construction to catering and everything in between, help grow the economy of New York City and beyond as M/WBEs and EBEs,” said NGLCC Co-Founder & President Justin Nelson.

New and Current NGLCC Certified LGBTBE® suppliers can utilize their existing certification to meet a majority of criteria needed to be certified by NYC’s Department of Small Business Services (SBS). The additional information required will be submitted via electronic addendum provided when a supplier begins the online application with the City of New York. Learn more at nglcc.org/nyc.

“Equity of access and inclusion are at the core of the work we do at SBS,” said Jonnel Doris, Commissioner of the NYC Department of Small Business Services. “A diverse vendor pool makes a stronger New York City, and we are excited to maximize the inclusion of LGBTQ certified firms into the City’s certification process. We look forward to our continued partnership with the NGLCC.”

This policy makes New York City the next city to intentionally include LGBT-owned businesses in municipal contracting and procurement opportunities, a best practice of the private sector and of an ever-growing number of states and municipalities. Thanks to the advocacy of NGLCC and its state and local affiliate chambers, New York City follows in the footsteps of large cities like Chicago, Orlando, Nashville, and more as inclusive leaders throughout the United States.

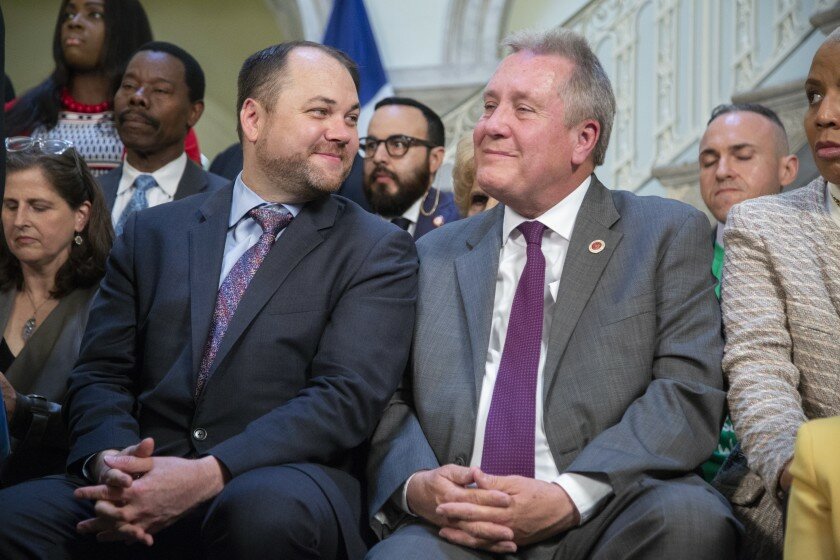

NGLCC wishes to thank Congressman Ritchie Torres for introducing a New York City Council bill to push this issue forward, which was first raised by Councilmember Daniel Dromm and members of the LGBTQ Caucus.

“LGBTQ-owned businesses in NYC will finally have equal access to city economic development programs thanks to this historic agreement,” said NYC Council LGBT Caucus Chair Daniel Dromm. “When it comes to establishing and growing businesses, LGBTQ entrepreneurs face many significant and manifold challenges. I am pleased that these business owners who were once excluded from sorely-needed contracting and procurement opportunities will be able to participate. I have worked alongside Congressmember Ritchie Torres and the NGLCC to sounds the alarm and raise awareness of this effort which is ultimately about fairness and equity. Thank you to SBS for stepping up and agreeing to this partnership. It will impact the lives of thousands of New Yorkers in a meaningful and lasting way.”

In August 2019, at the 2019 NGLCC International Business & Leadership Conference in Tampa, FL, openly LGBT Mayor Jane Castor announced an executive order to include Certified LGBTBE® suppliers in her city. This order followed Mayor Eric Garcetti’s historic announcement to do the same in Los Angeles just days before, as well as Chicago Mayor Lori Lightfoot’s resolution to do the same in her city. In 2018 and early 2019, NGLCC won the inclusion of Certified LGBTBE® suppliers in Orlando, FL; Nashville, TN; Baltimore, MD; Jersey City, NJ; and Hoboken, NJ, while also advancing statewide bills in New York and New Jersey. Currently, California, Massachusetts, and Pennsylvania also include Certified LGBTBE® suppliers in city procurement, along with major cities like Seattle, Newark, Columbus, and Philadelphia. Many of America’s largest cities and states are working closely with NGLCC to complete LGBTBE inclusion in 2021.

“While we have a long way to go for LGBT equality in the nation, NYC has always had a strong and growing network of NGLCC Certified LGBTBE® suppliers and LGBT-owned companies. We hope this resolution in NYC will encourage more cities to proactively include the LGBT community for the optimum social and economic health of their cities. Collectively, LGBT-owned businesses contribute to the $1.7 trillion dollars that the LGBT business community puts into the national economy. Progressive and inclusive leadership, like that of New York City, will ensure greater access to the American Dream for every American,” said NGLCC Co-Founder & CEO Chance Mitchell.

Read more here.

EmailNews.preview.jpg)